Building financial security in my 70s

Wisdom from entrepreneur and author Dr. George C. Fraser by Word In Black We all have different ideas about what financial security looks like. For some of us, it’s owning a luxury car and having disposable income. For others of us, it’s having enough money saved up in case of an unforeseeable circumstance. We’re all capable … Continued The post Building financial security in my 70s appeared first on New Pittsburgh Courier.

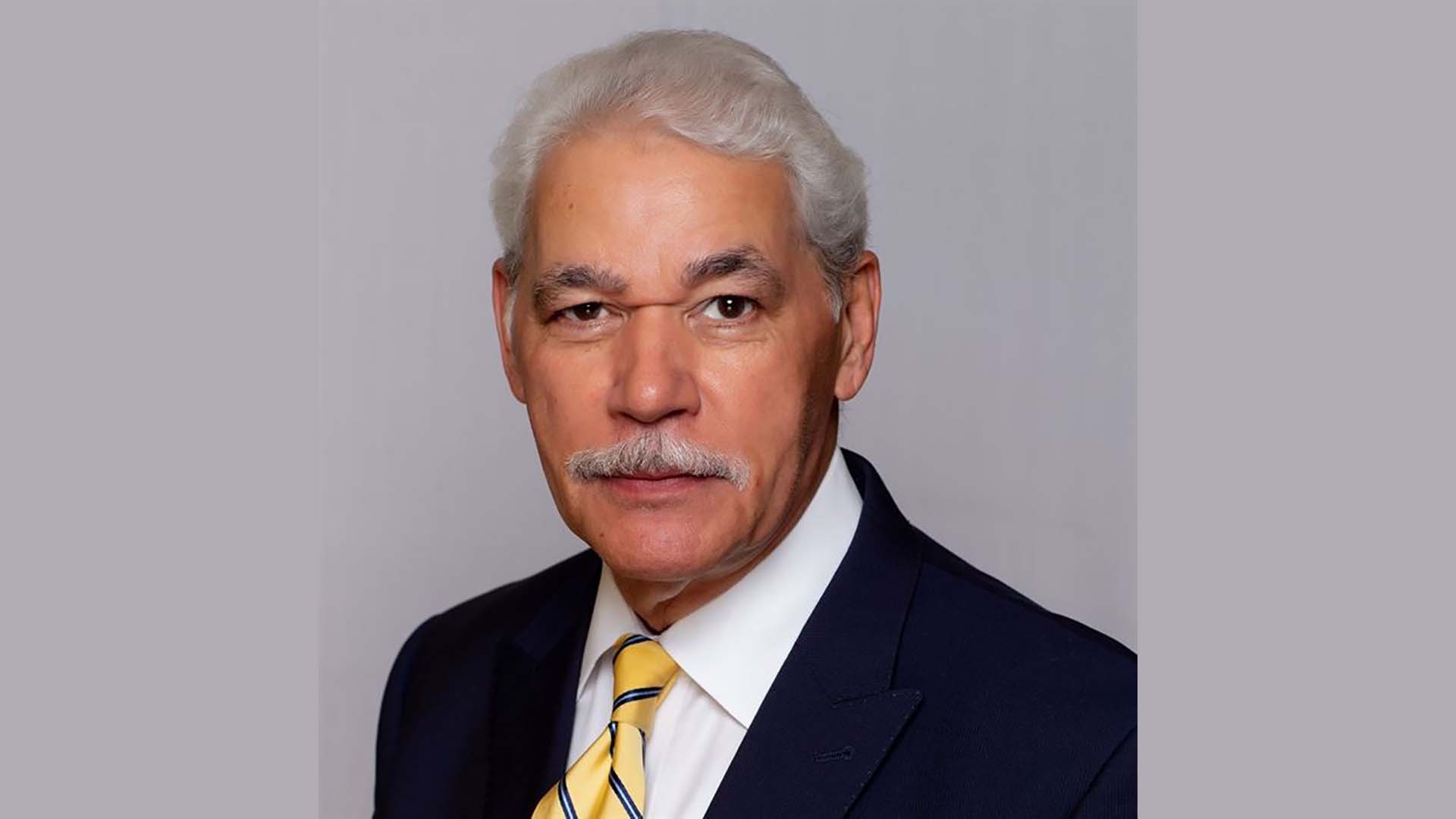

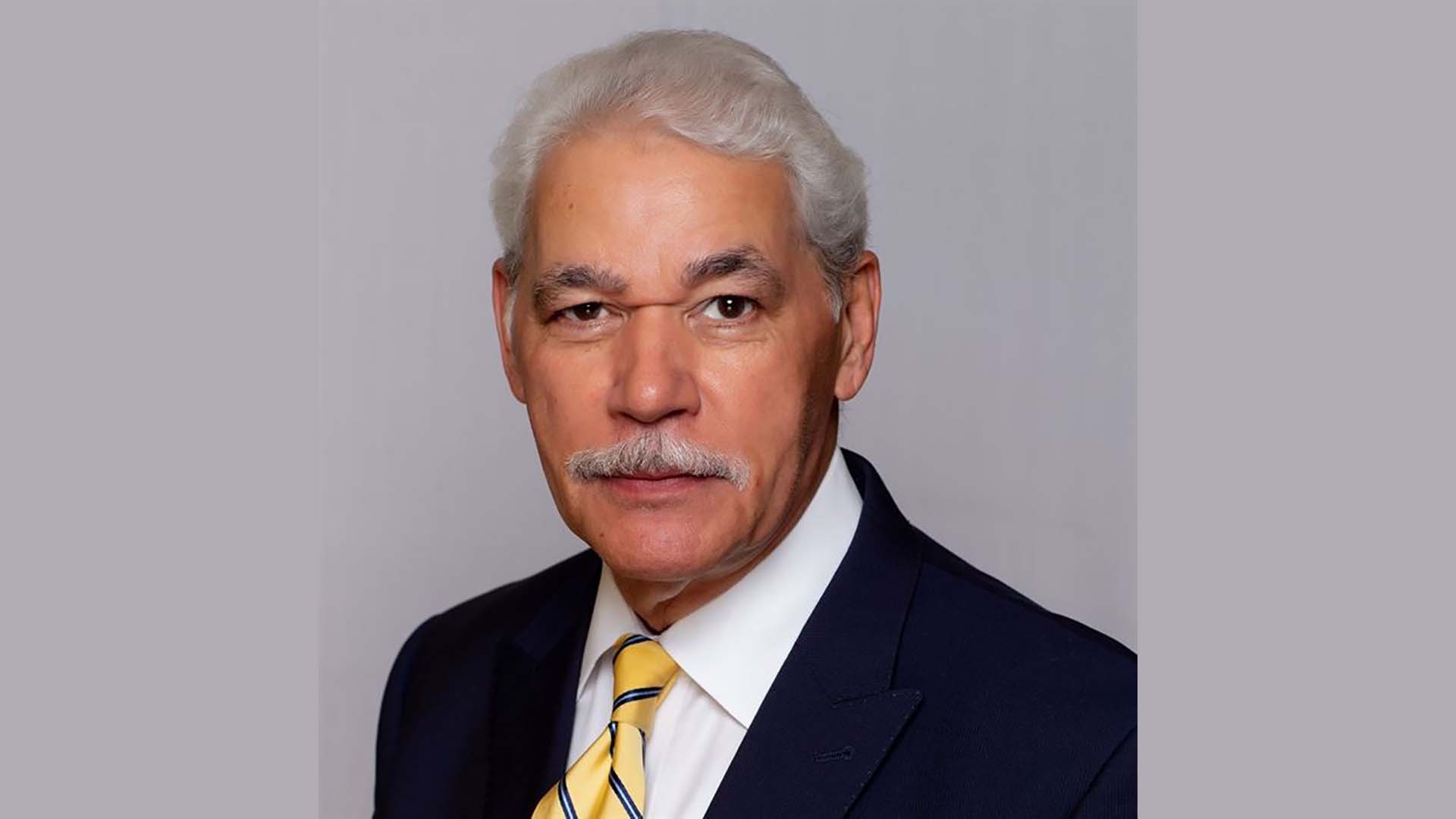

Wisdom from entrepreneur and author Dr. George C. Fraser

by Word In Black

We all have different ideas about what financial security looks like. For some of us, it’s owning a luxury car and having disposable income. For others of us, it’s having enough money saved up in case of an unforeseeable circumstance. We’re all capable of building financial security at any age.

Dr. George C. Fraser began his journey toward understanding the value of financial stability more than forty years ago. Now, at age 76, the Cleveland-based entrepreneur and author of Success Runs in Our Race: The Complete Guide to Effective Networking in the Black Community shares insight about building wealth for the long haul—even in the midst of uncertain times.

How do you define financial security?

An adequate amount of assets to live a comfortable life for you and your family till death do you part—plus to leave some assets to your children. Basically, assets have to be converted to cash, whether it’s cryptocurrency, stocks, bonds, mutual funds, etc. You save and invest first, and then you spend. That is a fundamental philosophy of building assets.

Has this always been your definition of financial security?

Certainly at 76, it changes. The first, let’s say, five to six passages (each passage is about ten years) is about developing skills, finding one’s purpose (that which is going to bring you the greatest degree of satisfaction), then monetizing that so you’re doing work that you love so it’s really not work. And then particularly managing and investing those assets for leverage to increase them in value to sustain your life when you’re working, obviously, and beyond that. For me, retiring simply means doing the work that I love.

Do you consider yourself retired right now?

No. I probably wouldn’t. Today, I don’t think if you love what you do, you have to stop working. Some of the greatest achievers to have ever lived worked until they died: Frank Lloyd Wright, the great American architect, built his magnum opus —the Guggenheim Museum on 54th & 7th Avenue in New York City—he completed it when he was 91.

How has COVID-19 affected your view of financial security?

God has an interesting way of sending us to war because when we are at war, we get creative. I was in the business of putting on events for 40 years. I went from deep six figures to zero. Of course, I had savings and assets and all that kind of stuff, but you try not to deplete that. The first thing is to get back to making a living. That’s Step One. I had to reinvent my livelihood by doing the things that I know how to do and love to do like speaking and putting on events. For the two years that I couldn’t have my Big Power Networking Conference, I did it virtually; won all kinds of awards. It forced me to think outside of the box. It forced me to learn new skills. Step Two: You get back to building excess assets to make new investments. What’s the other big thing that happened during the pandemic? The mass adoption of cryptocurrency, which will have a seismic impact on the economic system of the world in five or ten years.

What do you wish more African Americans understood about building and managing wealth?

Every Black family should have a goal of owning land, buying gold, and getting involved and invested in cryptocurrency. You should have life insurance. You should have a limited liability corporation—an LLC—because of the tax advantages. You should have an investment account. You should have stocks, a trust, an established will, and produce a product. If I have to write a list, what every Black family will have in the future, it would be those things.

Is being a subject-matter-expert helpful for wealth-building?

You have to be a 360-degree person. Specialization is for insects. You just cannot exclusively and only be a specialist. You have to interact with people, to talk with people. You have to solve problems. You have to think. Critical thinking is critical.

Relationships are assets, too.

Relationships can be an asset and then relationships can be monetized, as well. You can’t do anything of significance on your own by yourself in a vacuum.

What are your financial rules for financial freedom?

Simple little rules:

- Your rent or your mortgage should be less than what you make in a week. That’s rule number one.

- Only borrow money to make more money.

- As your income increases, your cost of living should decrease or stay the same. In other words, live below your means and invest the rest.

EVERY BLACK FAMILY should have a goal of owning land, buying gold, and getting involved and invested in cryptocurrency.

The post Building financial security in my 70s appeared first on New Pittsburgh Courier.